Do you own an LLC and need some information on how to pay tax? You’re in the right place. This guide covers everything you need to know about how LLCs are taxed. First up is income tax.

LLCs pay federal and state taxes on all income earned. However, these earnings are passed through to company owners who pay tax on this revenue as part of their personal tax return. Additional taxes may apply depending on the nature of your company and where you conduct business.

Informational Purposes Only

This article is for informational purposes only and does not constitute legal or tax advice. You should consult with a licensed professional regarding your specific business needs. For more see our full disclaimer page.

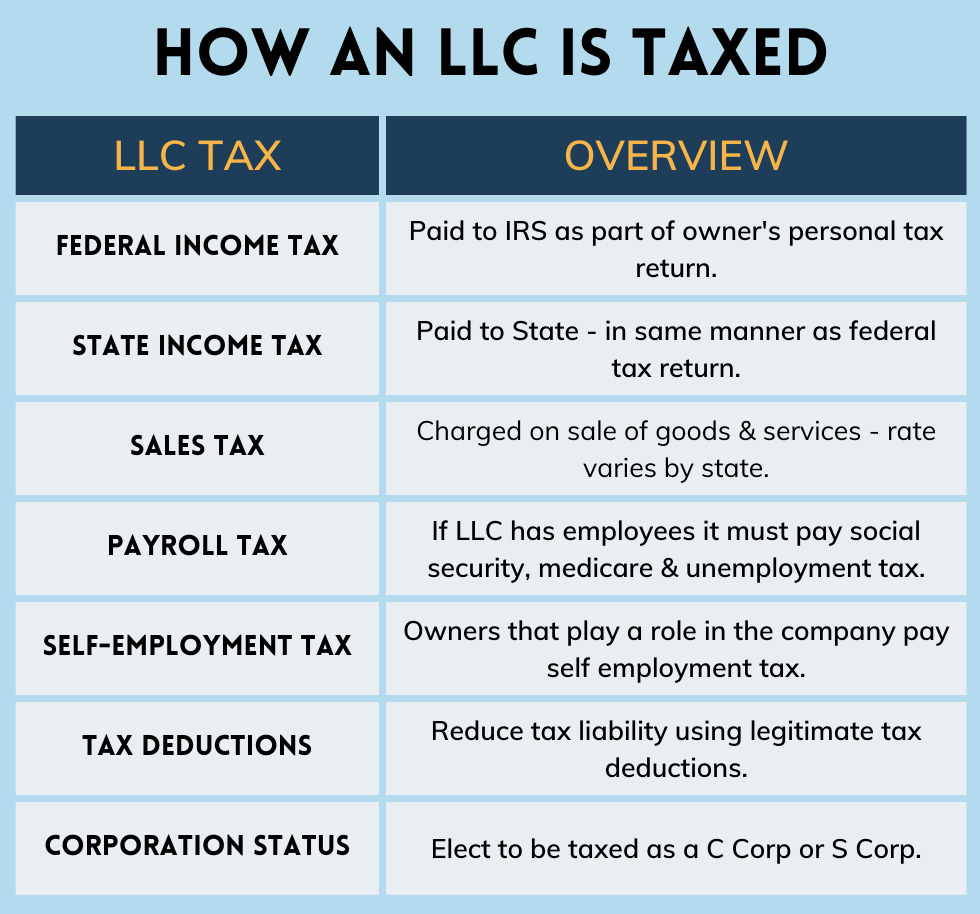

These additional taxes include sales, payroll, and self-employment tax. You will also need to consider tax deductions to reduce your overall tax burden and the possibility of electing a corporate tax regime for your LLC. See below for a simple overview.

HOW LLCs ARE TAXED

LLCs are taxed in a similar manner to sole proprietorships and partnerships. If the LLC has a single member, it is taxed in much the same way as a sole proprietorship. If it has more than one member, it is taxed in a similar manner to a proprietorship.

An LLC is classed as a pass-through entity by the IRS. This means it does not have to pay tax on its income in the way a corporation does. Instead, any income generated will be taxed as part of the personal tax returns of the company’s owners.

LLC TAX REQUIREMENTS – HOW IT WORKS

In this article, we cover the following areas in simple and clear terms.

- FEDERAL INCOME TAX

- STATE INCOME TAX

- SALES TAX

- PAYROLL TAX

- SELF-EMPLOYMENT TAX

- TAX DEDUCTIONS

- CLASSING AN LLC AS A CORPORATION

LLC FEDERAL INCOME TAX

Federal income tax is collected by the IRS. The IRS does not impose a tax directly on LLCs. Instead, they benefit from what is known as “pass-through” taxation. This means the profits earned by an LLC pass through in full to their owners without paying tax.

These profits are then taxed as part of each owner’s personal tax return. Note, an LLC member must pay tax on their share of company profits regardless of whether they receive the income or not.

For example, if an LLC member chooses to leave their share of profits in the company to cover future expenses – they must pay tax on these profits, even though they have not been received.

There are two types of LLC. An LLC with just one owner is called a Single-Member LLC. And, an LLC with more than one owner is called a Multi-Member LLC. Let’s take a look at how single-member and multi-member LLCs pay income tax to the IRS.

SINGLE-MEMBER LLC INCOME TAX

An LLC with just one member is taxed in the same way as a sole proprietorship. The LLC itself does not have to file a tax return with the IRS. The owner of a single-member LLC reports all company profits or losses on form 1040 as part of their individual income tax return.

MULTI-MEMBER LLC INCOME TAX

An LLC with multiple owners is taxed by the IRS in a similar way as a partnership. The LLC does not pay any tax on the income it earns. Instead, the profits are passed through to the LLC’s members in full. Each member then pays tax on these earnings as part of their personal income tax return.

Tax form Schedule K-1 should be completed to show how company profits have been divided and distributed amongst each member. And, form 1065 ‘U.S. Return of Partnership Income’ should be completed and submitted to the IRS for informational purposes.

LLC STATE TAX

LLCs must also pay tax at a state level. Most states tax LLCs in the same way as the IRS. This means company profits pass through to members without being taxed at a company level. Each member then pays tax on these earnings as part of their individual tax return.

How much taxes do LLC pay? Well, it varies from state to state. Some states apply additional taxes on LLCs based on company earnings and as part of an annual registration fee – see below.

STATE INCOME TAX

Some states charge tax based on the level of income the LLC generates. For example, both California and Texas tax LLCs based on their annual earnings. In Texas, an LLC with earnings between $1.18 million and $10 million pays a state franchise tax of 0.375%

ANNUAL STATE REGISTRATION FEES

Many states charge a recurring annual or biennial fee – often overlooked as an LLC tax. It is often due when submitting an annual report to the state authorities.

This fee is not income-related and varies between $40 to $500 depending on state. For a breakdown of LLC costs by state, check out our State by State Guide to LLC Costs.

READ NEXT

- Tax Benefits of LLC

- Best LLC Formation Services

- How to Sell or Close Your LLC

- Forming LLC with Friends & Family

LLC SALES TAX

If the LLC sells goods and services you will have to collect sales tax. Sales tax is collected from the customer at the point of sale. The rate that applies varies depending on the state you are doing business in, and not all states apply a sales tax.

Alaska, Delaware, Montana, New Hampshire, Oregon, and Guam do not apply a statewide tax. However select goods and services may be taxed: such as tobacco, alcohol, and fuel

In regions where a sales tax is applied, it generally follows one of two rules. It can be either a Destination-Based Tax or an Origin-Based tax.

A destination-based sale tax applies the tax rate of the final delivery location of the good or service. And, an origin-based tax applies the sales tax rate from the location the good or service originated from.

To find out more, you will need to contact the Department of Revenue in your local State authority.

LLC PAYROLL TAX

If an LLC has employees it must pay federal payroll taxes. These taxes are collected by the IRS. Payroll taxes include unemployment taxes, social security taxes, and Medicare.

Social security and Medicare are collectively known as FICA taxes. Employees and employers share in the payment of FICA taxes. However, it is the employer’s responsibility to withhold the employee’s share of these taxes from their paycheck.

LLC payroll taxes are filed using two IRS forms – Form 940 and Form 941. Form 940 is filled to report the LLC’s annual unemployment tax obligations. And, Form 941 is used to report withheld social security, Medicare, and income tax.

LLC SELF-EMPLOYMENT TAX

LLC members that work or play a role in managing the company must pay self-employment tax. However, members that play no role in running or making decisions on behalf of the LLC may be exempt.

In line with the Self Employment Contributions Act (SECA) – LLC owners that work in the company must pay social security and Medicare. The tax is charged at a rate of 15.3%, for most business owners, and is paid directly to the IRS using a Schedule SE form. See below for a breakdown of how the tax is applied.

- Social Security: 12.4% on earnings up to $147,000

- Medicare: 2.9%

Note: Medicare charges an additional 0.9% on income above $125,000 (married filing separately), $250,000 (married filing jointly), or $200,000 (all other taxpayers).

LLC TAX DEDUCTIONS

Tax deductions allow you to reduce the amount of revenue your company will be taxed on. Legitimate business expenses can be deducted from the profits generated by the company. This in effect reduces the tax liability and has a significant impact on how LLCs are taxed.

Deductible expenses include costs incurred in setting up and running your business. Examples include start-up costs, general office maintenance costs, utilities, computer software, advertising and marketing, car expenses (including parking), educational courses, and health insurance premiums.

To maximize your tax deductions you should consult a tax accountant. They will offer professional advice on how to best process your tax deductions and reduce your tax liability with the IRS. For more check out our guide on LLC Tax Deductions.

ELECTING CORPORATION TAX STATUS

Corporation status is a topic that often crops up when covering how LLCs are taxed. An LLC can choose to be taxed as a corporation. In some situations, it is in an owner’s interest to class an LLC as a corporation rather than follow the default tax rules. An LLC can elect to be taxed as either a C Corporation or an S Corporation. In all other legal aspects, the company will continue to operate as an LLC.

C corporations pay federal corporate tax at a rate of 21%. Owners will also pay personal income tax on any earnings received from the company. In effect, the company profits are taxed twice. The advantage of forming a C corp is that earnings retained in the company are not subject to personal income tax. For more see our full guide – LLC vs C Corp.

S corporations are taxed in a similar way to an LLC. They too benefit from pass-through taxation. S corps can save you money if you run a large LLC with significant earnings. However, S Corps have additional operating costs such as accounting and payroll. For more check out LLC vs S Corp.

To elect C Corp taxation status for an LLC you must complete Form 8832 and submit it to the IRS. And, to choose S Corp taxation status for your company you must complete Form 2553. Once regime is changed LLCs are taxed accordingly.

ABOUT THE AUTHOR

Jennifer Matheis – LLC Formation Specialist

Jennifer is our in-house LLC formation specialist. She is a graduate of the Ross School of Business at the University of Michigan and holds a Master of Business Administration. Jennifer has worked as a business management consultant in an advisory role for many years.

Hailing from Buffalo New York, Jennifer is a firm believer in the ‘seize the day’ mantra. When she is not writing for My LLC Guide she is busy managing one of her many start-up ventures. She is a keen sports fan and regularly attends Madison Square Garden to support the New York Knicks.