Welcome to My LLC Guide. We are your one-stop shop for everything you need to know about forming an LLC. Are you looking for the Best LLC Formation Service Reviews 2026? You’re in the right place. Check out our independent LLC formation company reviews below – we’ll help you choose the best service for you and your business.

THE BEST LLC FORMATION SERVICE 2026

Informational Purposes Only

This article is for informational purposes only and does not constitute legal or tax advice. You should consult with a licensed professional regarding your specific business needs. For more see our full disclaimer page.

Affiliate Disclosure

My LLC Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission at no extra cost to you. This helps us continue to provide independent research and testing. We only recommend products we believe in.

Best Online LLC Formation Service Reviews

1: NORTHWEST

2: ZEN BUSINESS

3: ROCKET LAWYER

4: INC FILE

5: LEGAL ZOOM

NORTHWEST REGISTERED AGENT REVIEW

Northwest Registered Agent is the best LLC formation service in 2026. They top our LLC service review thanks to their unrivaled customer support, reasonable pricing, and small business support features.

SPECIAL OFFER TODAY: $39

Looking for a good deal? You can pick up the Northwest LLC formation service for the cut price of just $39. This includes everything you need to get your company officially formed by a team of highly professional specialists. In our opinion, it’s the best deal currently on the market.

EXCELLENT CUSTOMER SERVICE

One of the stand out features of Northwest is its excellent customer service. The company employs a team of highly trained, helpful US-based specialists.

All customer support is handled in-house and nothing is outsourced to a third-party company. If you contact Northwest for support you will be quickly put through to a ‘Corporate Guide’ for assistance.

Northwest is a great company for business owners looking for a clear, straightforward, and responsive LLC service. And, the online registration process is easy to use and well laid out.

FREE REGISTERED AGENT

Northwest bundles their registered agent service together with their filing service. The two come together as one package. The good news is the registered agent is offered free for the first year. It then costs $125 per year.

The registered agent service provides you with a business address managed by Northwest. All legal documents and notices will be sent to this address. It’s a great way to protect your privacy. Especially if you are operating your LLC from your home.

GREAT FOR SMALL BUSINESSES

Northwest is a great option for small businesses. They offer quick, hassle-free LLC registration without all the fuss. And, their industry-leading customer service is a breath of fresh to their customers.

They offer a range of business tools that work well for small businesses. Amongst them is a virtual office feature that allows you to choose a business address in most states across the US. It includes phone service, physical mail forwarding, office lease and suite number, and same-day digital scanning.

REASONABLE PRICING

Northwest offers hassle-free, easy-to-use LLC registration at a reasonable price. While it is not the lowest price on the market, it’s a great deal considering the level of support and expertise offered.

The basic fee is $225. This includes a $100 filing fee and a $125 per year registered agent fee. State filing fees will then be added to arrive at your final figure. And, you can choose to pay everything up front or in monthly installments over the year.

FREE DIY SERVICE

They also offer a completely free DIY service. All you have to do is register on the website and create an account for your business. Then follow the do-it-yourself step-by-step guide to complete the filing process yourself.

The tool is completely free. If at any stage you decide you want Northwest to get involved and help you over the finish line they can pick up exactly where you left off and assist you in completing your registration. We think it’s a great idea.

PROS

CUSTOMER SERVICE

Northwest is well known for having industry-leading in-house customer support.

FREE REGISTERED AGENT

The registered agent service is bundled with the filing service and is free for the first year.

GREAT FOR SMALL BUSINESSES

Northwest is an excellent choice for small businesses and business owners new to LLC filing.

FREE DIY FILING TOOL

The site provides a free online DIY filing tool. The tool takes you through the process step-by-step and there are no hidden costs.

REASONABLE PRICING

The Northwest pricing structure is fair and transparent. For the services delivered you get good value for money. They score very highly here.

CONS

REGISTERED AGENT NON-OPTIONAL

The registered agent service comes as standard with the filing service. They are bundled together and cannot be purchased separately.

NO WEBSITE HOSTING

Northwest does not offer any website hosting or support. If you plan on building a website for your company need assistance you will have to look elsewhere.

OPTIONAL ADD-ONS

Optional add-on services can drive the price upwards. We advise you review the costs involved before opting in on any add-ons if you want to keep your costs down.

SUMMARY

Northwest is an excellent LLC formation service. They deliver industry-leading customer support, superb in-house expertise, and a simple hassle-free LLC filing service.

We recommend Northwest for small businesses, newcomers, and business owners that prioritize customer service. They offer a free registered agent for the first year, a suite of helpful tools including a virtual office, and very reasonable pricing.

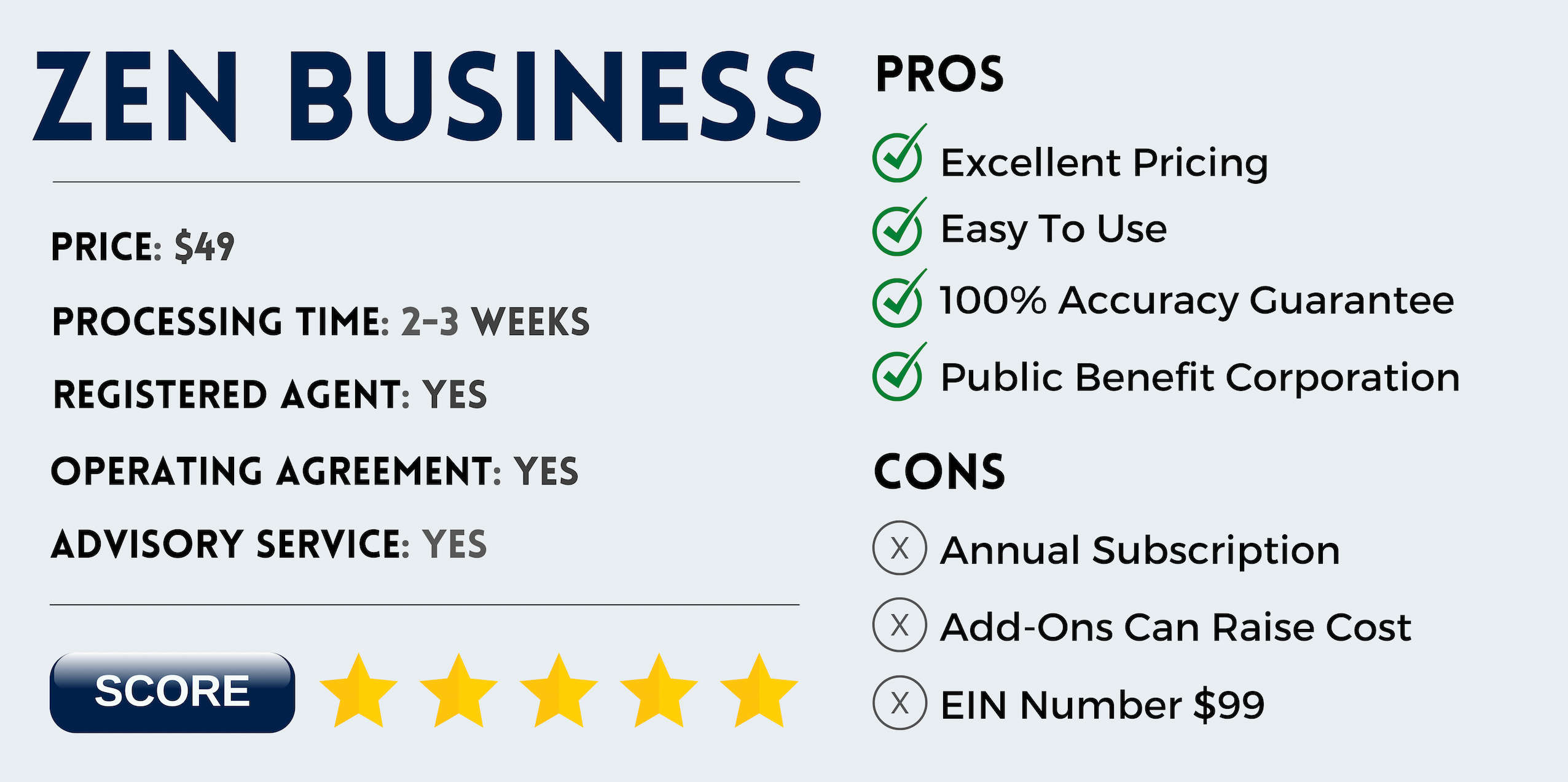

ZEN BUSINESS REVIEW

Zen Business is a great choice for online LLC registration services. Their starter package is incredible value at just $49 and includes all the essentials you need to get your filing processed. They offer flexible plans to cater to different customer needs and their online platform is very easy to use.

EXCELLENT PRICING

Zen Business offers outstanding value for money. Their introductory Starter Plan costs just $49 plus state fees. And, this package includes everything you need to get your LLC filed and up and running.

This is one of the most competitively priced LLC formation services on the market. And, rest assured, they haven’t taken any short cuts. You have the option of upgrading to premium plans if there are additional services you require for your company.

THREE PLANS AVAILABLE

Zen Business offers three plans – Starter, Pro, and Premium. The Starter Plan, ($49), includes standard filing, an operating agreement, and a one-year free registered agent service. Beyond this, the registered agent costs $119 per year.

You will also have access to responsive customer support within regular business hours and an online dashboard so you can track the status of your filing.

The Pro Plan costs $249 and offers expedited LLC registration of just 4-6 days. It also comes with an EIN number, website domain name registration, and a worry-free compliance guarantee.

And finally, the Premium Plan priced at $349 includes all of the above plus accountant chat support, monthly accounting services, and a business bank account.

EASY TO USE PLATFORM

The Zen Business formation services are incredibly easy to use. Everything is clearly laid out and the steps you need to take are explained in simple terms. Just, sign-up, create your account, and away you go.

All you have to do is select your business type, choose a state to register in, and decide which plan works best for you. There’s even an a-la-carte section where you can pick and choose the exact services you want – if the three plans on offer are not meeting your exact needs.

They offer responsive telephone and chat support. And their assistants can be reached any time during regular business hours. Zen strives to ensure your filing will be a smooth and hassle-free process.

FREE REGISTERED AGENT

Zen provides one full year of registered agent service free with all three packages. Beyond this, you will have to pay an annual subscription of $119. However, the price can vary depending on business type and size.

A registered agent service provides you with a business address that all legal documents will be sent to. Zen will then notify you of anything significant that requires your attention. All businesses require a registered agent and using a third-party service is a great way of protecting your privacy.

OUTSTANDING CUSTOMER REVIEWS

Zen performs well when it comes to customer reviews – always a good sign. Their existing customers are very happy with the service that has been provided.

They have a score of ‘A’ on Better Business Bureau. This is a high score and represents 94 on a scale of 100. And, they have a rating of 4.32/5 based on 131 customer reviews. Pretty impressive!

The feedback on Trust Pilot is equally positive. Here they score a reassuring 4.7/5 based on over 8,500 customer reviews, making them one of the top LLC formation services 2026.

PUBLIC BENEFIT CORPORATION

Zen Business is a Public Benefit Corporation. This means they are a for-profit company that also contributes to the wellbeing of society, the community, or the environment. In fact, they have written these public benefit goals into their company bylaws.

The company actively supports businesses owned by women, black, indigenous, and people of color (BIPOC) by providing grants. They also support the LGBTQIA+ community.

PROS

VALUE FOR MONEY

Zen’s pricing model is incredibly competitive and right up there with the best packages on offer.

EASY TO USE PLATFORM

They provide a simple, clear, easy-to-use platform to get your LLC registered.

MULTIPLE PLANS AVAILABLE

They offer three plans to choose from – standard, pro, and premium. There is also an a-la-carte option that allows you to choose the exact services you require.

FREE REGISTERED AGENT

All plans include a free registered agent service for the first year.

VERY POSITIVE REVIEWS

The company performs superbly when it comes to customer reviews – with excellent scores on BBB and Trust Pilot.

PUBLIC BENEFIT COMPANY

They have a social conscience and are registered as a public benefit company. This means they give back to the community by providing grants to eligible businesses and groups.

CONS

ANNUAL SUBSCRIPTION

Some fees are recurring and will involve an annual subscription, for example – a registered agent.

ADD ONS CAN RAISE COST

Adding on additional optional services can push costs upwards.

EIN TAX NUMBER

An Employer Identification Number is not included in the Standard Plan and will cost an additional $99.

SUMMARY

Zen Business is an excellent choice for LLC registration services. They offer incredible value, flexible plan options, and a very easy-to-use online platform. Their Standard Plan registration option offers everything you need to your LLC filed at just $49 plus state fees.

In addition, you get a free registered agent service for the first year with an option to renew thereafter. There’s a free accounting consultation and tax assessment to help you get off on the right footing. And, they have received glowing reviews from their existing customers.

ROCKET LAWYER REVIEW

Rocket lawyer is a company that specializes in offering legal advice. If you want to form an LLC and also need professional legal guidance – then Rocket Lawyer is a great choice for you. Their premium service combines ongoing legal assistance and company registration and makes it a strong entry in our LLC service reviews.

COMPANY EXPERIENCE

Rocket Lawyer is a highly experienced company and is held in high regard in the business services world. Based in San Francisco, California, the company was formed back in 2008. Since then they have built up a wealth of experience in their industry.

They have served millions of customers over that time, many of whom were business owners. If you value a company with a proven track record it is difficult to look beyond Rocket Lawyer’s industry experience.

LEGAL SERVICES

As the name suggests, Rocket Lawyer specializes in offering legal advice. If you’re a business owner that needs to get an LLC registered but also has an interest in ongoing legal advice – then this company could be a great fit for you.

In addition to the regular business filing service, you can sign up for premium membership for $39.99 per month. This will give you access to the company’s legal advisors, a library of legal documents, and a 30-minute legal consultation. Is ongoing legal support something you require?

PRICING OPTIONS

Rocket Lawyer offers a choice of two pricing plans. You can either sign up for premium membership for $39.99 per month. Or, you can just pay a one-off fee of $99.99to to get your LLC papers filed.

The premium membership includes a suite of tools and legal advisory services that many business owners will find appealing. It does however involve a monthly recurring charge – so you need to factor this in to see if it is a good fit for you.

Membership includes the registration of your LLC business at no extra cost. The free filing is limited to one company per membership. You’ll have to pay an additional fee if you need to get any other businesses registered.

GENEROUS FREE TRIAL

Rocket Lawyer offers a one-week free trial and we think this is a great feature. It allows you to get a feel of what the company has to offer before you commit to a monthly membership fee. This makes them one of the best rated online LLC formation services.

The free trial covers all the features you can expect to avail of as a premium member. These include legal document templates, attorney services, and online form signing. The attorney service allows you to consult an attorney for 30 minutes to address any questions you may have concerning your business.

REGISTERED AGENT SERVICE

A registered agent service is available. But it comes at an additional cost. It will cost you an extra $111 per year if you sign up as a premium member. Or, you can pay $149 per year as a non-member.

Hiring a registered agent service means you can avoid using your home or business address for legal correspondence. Everything will get sent to your registered agent who will then contact you if anything arises that requires your attention.

POSITIVE REVIEWS

Rocket Lawyer have generally positive reviews from their past customers. The company has been in business since 2008 and has served millions of customers over those years.

They have scored a 4.7/5 on Trust Pilot from over 4,500 reviews. And, on Better Business Bureau they have an impressive A+ rating with a customer review score of 4.61/5.

One point to consider when evaluating these reviews is that Rocket Lawyer is not an LLC specialist service. Many of these reviews will be based on the legal advice they offered their clients.

PROS

LEGAL ADVICE

The key selling point for Rocket Lawyer is the legal support and advice they offer. If you will require ongoing legal advice on how best to run your business – Rocket Lawyer could be a great fit.

EXPERIENCE

They come with many years of experience. The company was set up in 2008 and has served millions of customers since then. They have a wealth of industry knowledge.

PRICING OPTIONS

Two pricing options are available. You can either sign up as a member and pay $39.99 per month. Or, you can pay $99.99 to get your LLC registered and an additional fee of $149 for a registered agent.

1-WEEK FREE TRIAL

There is a one-week free trial available before you sign up for premium membership. This gives you full access to all the tools and benefits you can expect as a premium member.

GLOWING REVIEWS

The company has received excellent reviews from its previous customers. They score an impressive 4.7/5 on Trust Pilot and have an A+ rating on Better Business Bureau.

CONS

RECURRING MEMBERSHIP COSTS

If you choose to sign up as a member you will have to pay a recurring monthly fee of $39.99. This works out at almost $480 per year.

LEGAL SPECIALISTS

Rocket Lawyer are not a business filing specialist company. Legal advice sits at the core of their business. However, this may be a positive depending on your business needs.

REGISTERED AGENT

If you wish to sign up for their registered agent services it will cost you an additional $149 per year, from year one. Some competitors offer the first year for free when you sign up.

SUMMARY

Rocket Lawyer are an excellent LLC registration company, especially if you require ongoing legal advice. In addition to LLC registration, Rocket Lawyer offers a range of legal support and advisory services.

If you sign up for premium membership you will benefit from ongoing legal advice and a 30-minute legal consultation to address any questions you may have. If you would prefer not to sign up as a member you can avail of their business registration services for a one-off cost.

They are a highly experienced company and served millions of customers since they were first established in 2008. And, they boast a wealth of positive reviews on Trust Pilot and the Better Business Bureau.

INCFILE REVIEW

Incfile is an excellent choice for LLC formation if you are operating on a tight budget. They offer three packages at different price points – silver, gold, and platinum. And, the basic package is available completely free for the first twelve months.

OUTSTANDING VALUE

Incfile’s LLC formation service is superb value. In fact, they offer the basic silver package completely free for the first year. And, it includes everything you need to get your LLC filed with the state authority. All you have to pay are your local state fees.

The basic package covers the filing of your LLC articles of organization and a registered agent service. Everything is free for the first 12 months and then an annual fee of $119 kicks in.

If you are looking for a package with additional services such as tax consulting, an operating agreement, and EIN – check out the gold and silver packages below. They are one of our best online LLC formation service options for 2026.

FAST FILING

Another key selling point for Incfile is its incredibly fast processing time. The company state that they strive to process every application within one business day. This means that within one day of receiving your LLC filing application – they will strive to file your paperwork with the relevant state authority.

It does not mean that your LLC will be filed and formed within one day. Incfile has no control over the length of time it takes for the state authorities to complete the filing on their side.

THREE OPTIONS AVAILABLE

Incfile has three packages to choose from – silver, gold, and platinum. Silver is the basic package and the cheapest option. Gold and platinum are upgrade packages that include additional services – with platinum being the premium option.

These three options provide plenty of flexibility for most business owners and they are reasonably priced. If you choose a package that does not contain a service you need – take a look at the additional services section below.

• SILVER PACKAGE

The silver package is Incfile’s cheapest and most basic service. It is priced at $119 per year, plus state fees. Even better, it is completely free for the first year. Great promotion.

The package includes all the basics including company formation filing, next-day processing, and a registered agent service. The silver option is a great introductory package for new small businesses operating on a tight budget.

It’s hard to argue with a completely free service for the first 12 months – and the fee of $119 is reasonable for the level of services provided. However, if you are looking for more for your new LLC – check out the gold and platinum options below.

• GOLD PACKAGE

The gold package is the next step up from silver. This option is priced at $149 plus state fees. It includes all the services found in the silver package plus an operating agreement, tax consultation, EIN tax ID, S corporation election, and a banking resolution document.

• PLATINUM PACKAGE

The platinum package includes everything from the silver and gold options but comes with expedited filing, contract templates, business domain name, and email for one year. This service is priced at $299 per year plus state fees.

REGISTERED AGENT

Incfile provides a regular agent service and it is free for the first year with all packages. After that, you will have to pay. If you wish to continue using the Incfile registered agent all you have to do is sign up for one of their three packages. The basic silver package is available at $119 per year.

ADDITIONAL SERVICES

If you want to add an additional service to your package, Incfile allows you to pick and choose the services you need – see below.

• ANNUAL REPORT ($99 + state fee)

Annual reports are a legal requirement and must be submitted to your local state authority – usually the Secretary of State. For $99 plus state fees, Incfile will take care of this obligation for you.

• BUSINESS LICENSE ($99)

Incfile will determine the business licenses your LLC needs to hold and process an application on your behalf.

• AMENDMENTS ($99 + state fees)

This add-on allows you to make changes to your articles of incorporation. Incfile will process the amendment for you for $99 plus state fees.

• FOREIGN QUALIFICATION ($149 + state fees)

You will need a foreign qualification if you intend to operate your business in a US state outside of the one it was formed in.

• VIRTUAL ADDRESS ($29/month)

The virtual address service provides your business with a street address and a virtual mailbox.

• LETTER OF GOOD STANDING ($49 + state fees)

This is a letter to formally assert that your business is registered and in compliance with state laws.

CUSTOMER REVIEWS

Incfile has generally positive reviews online and has scored well on both Better Business Bureau and Trust Pilot. The company has scored an impressive 4.65/5 based on 1,324 customer reviews on Better Business Bureau. And, the scores are equally impressive on Trust Pilot with a score of 4.6/5 based on 1,454 reviews.

PROS

FREE FILING SERVICE

Incfile offers a completely free LLC formation and registered agent service for the first 12 months. This includes everything you need to get your company up and running. If you are on a budget – this is an excellent option.

SILVER, GOLD & PLATINUM PACKAGES

There are three service packages to choose from. They offer basic, standard, and premium services and are priced accordingly.

FAST PROCESSING

Incfile strives to process all applications within one business day. This is an incredibly fast processing time and places them at the very top of the table for processing speed.

POSITIVE CUSTOMER REVIEWS

The company has thousands of positive customer reviews on rating sites Better Business Bureau and Trust Pilot – scoring 4.65/5 and 4.6/5 respectively.

ADDITIONAL SERVICES AVAILABLE

You can choose to add additional services to your package in an a-la-carte fashion for an extra fee. This gives great flexibility and allows you to tailor the service to your precise business needs.

CONS

UP-SELLING

Some customers have expressed frustration with attempts to up-sell additional services they didn’t want. Our advice is to stick to what you want and what your business needs – and avoid any up-selling. Something to watch out for when choosing the best LLC formations services.

PREMIUM SERVICE $299

The premium service, priced at $299 per year, will be too expensive for some small businesses starting out. If you are on a tight budget you can stick with the silver or gold packages. Or, even better, get the first 12 months completely free.

SUMMARY

Incfile is a great choice of LLC formation service. They offer outstanding value for money, an exceptionally fast processing speed, three graded packages, and a range of additional services that can be added on separately.

Not only are their silver, gold, and platinum packages very reasonably priced – they offer their basic silver package completely free for the first 12 months. It includes everything you need to get your LLC formed – paperwork filing with your state authority and a registered agent service.

They have positive feedback on customer review sites Better Business Bureau and Trust Pilot with scores in the region of 4.6/5 based on the reviews of thousands of satisfied customers. If you are a small company, on a budget, and want to form an LLC quickly – Incfile is definitely worth a look.

LLC FORMATION SERVICES GUIDE

- How We Review LLC Formation Companies

- How to Choose an LLC Formation Service

- Why Use an LLC Formation Service?

- Advice For Using a Formation Service

- How a Formation Service Works

- How To Form an LLC

- Other Types of Business Structure

- Frequently Asked Questions

HOW WE REVIEW THE BEST LLC FILING COMPANIES

There are several factors that need to be considered when reviewing the best LLC formation company. Below we take a look at the points you need to consider.

EXPERIENCE

What level of experience has the company? Are they new to the LLC formation service industry or do have they many years of experience.

Companies that have more experience may have a greater understanding of the LLC formation process. A little online research and a google search will quickly give you some background information on the company.

STANDARD SERVICES

The standard service offered by all LLC formation companies is the processing and filing of your LLC documents with the state authority to get your LLC business up and running.

All the best LLC formation companies will process your application from start to finish and ensure it is filed correctly and quickly with the state authority – usually the Secretary of State. Most companies offer additional services that you can opt into.

ADDITIONAL SERVICES

LLC formation companies often offer additional services that add value to your LLC registration package. These optional add-ons include registered agents services, an LLC operating agreement, EIN federal tax number, ongoing compliance support, and faster filing times.

It’s a good idea to consider the additional services on offer as some of them will really save you time and get your LLC off to a flying start. Take some time to see which ones are a good fit for your business.

PRICE

Take a look at the price for the service being offered. What’s included in the price. Does it offer good cost value? Take a look at what’s included in the package and distinguish between must-have and nice-to-have features.

Compare the price being offered across several companies to make sure you are getting a good deal. And remember, the lowest offer price is often not the best option when all factors are considered.

REGISTRATION TIME

How fast can the company process your registration? There can be significant differences in registration turnaround time between LLC services.

The best LLC formation companies turn around your registration quickly and efficiently. Many even offer an expedited service where for a small fee your application will be bumped up the line and processed more quickly.

TAX ADVICE

Do they offer tax advice? Getting professional tax advice from the outset is a great boost for any company. Is this something you are interested in?

If you have little experience in business tax and don’t already have an accountant this could be an invaluable service. Your LLC formation company can advise you on how best to proceed given your unique financial circumstances.

REGISTERED AGENT SERVICES

Many LLC service companies provide registered agent services. This means they will act as your registered agent or provide a third-party registered agent service.

If this is something you are interested in check to see if it is covered in the cost of the plan or does it involve an additional fee. A registered agent is someone that agrees to accept legal documents on behalf of the LLC. If you need an agent for your company – check out the Best Registered Agent Services.

EASE OF USE

Ease of use is a critical factor when hiring an LLC formation service. You want to engage the services of a company that is easy to work with and provides a stress-free service.

The best LLC formation companies make the process very easy. Others complicate matters with upsells, marketing techniques, and even misleading advertising.

We will advise you to avoid these companies and stick to the trusted LLC services that use proven streamlined processes.

CUSTOMER SUPPORT

Consider the level of customer support offered by each company. If the smoothest of operations can encounter a hitch from time to time.

If this happens you’ll want to be dealing with an excellent customer support service. The best LLC filing companies offer friendly, helpful customer service throughout the registration process.

A great way to get a feel for the level of customer support a company offers is to contact them before you commit to a purchase. Ask some questions and gauge how helpful they are in addressing your queries.

HOW TO CHOOSE THE BEST LLC REGISTRATION SERVICE FOR YOU

There’s a lot of competition out there in the LLC registration market. What’s the best way to evaluate your options and choose the best fit LLC registration service for you? There are a range of key points to consider. Ask yourself the following questions.

WHAT SERVICES DO YOU NEED?

When weighing up your options and choosing an LLC registration company the first thing you need to do is consider the services you need and the services offered by each company. Check to see if they offer a package that matches your requirements.

Are they flexible in the services being offered? Or, are they bundled together in packages that include services you don’t need? Consider the essential services versus the nice-to-have.

Essential services include the filing of an Articles of Organization document with the state authorities and the appointment of a registered agent. Anything else is an additional service – but some of these may be very beneficial in setting up your business.

WHAT LEVEL OF EXPERIENCE DO THEY HAVE?

It’s always good to check the track record of the company before you sign on the dotted line. Are they a well-established company with lots of LLC filing experience?

We recommend you pick a company with a proven track record that is familiar with the process involved and can assist you every step of the way. Experience is key when it comes to processing an LLC registration and ensuring all requirements are completed correctly.

WHAT IS THE FEE STRUCTURE?

Carefully compare the fees being charged by each company. Are some companies offering better rates? Also, clarify if the fee is a once-off payment or is it a recurring charge.

While the cost of a service is always an important consideration it should not be your deciding factor. Often, the cheapest package on offer is not the best one to go for. Factor it into your decision-making process but don’t allow it to be your only consideration.

HOW QUICKLY WILL THEY PROCESS YOUR LLC REGISTRATION?

How quickly can they process your application and complete your LLC registration? Ask each company how long they take to process an LLC filing. They should be able to give you some average time frames for each state. Are some companies quicker than others? We compare LLC formation services to see who can process your application most quickly.

HOW USER FRIENDLY IS THE PROCESS?

Ease of use is key. You don’t want to sign up with a company that is difficult to work with. The whole idea of hiring an LLC registration service is that they remove the hassle and stress of processing your application.

While it is difficult to tell from the outset how user-friendly the service may be, you can get a good idea of what to expect from our reviews above. It’s best to go with a filing service that processes your application with minimum fuss and complication.

WHAT LEVEL OF CUSTOMER SERVICE IS PROVIDED?

What level of customer service does the company offer? Will you require ongoing support during your application? Will you need advice to help you manage the LLC after it has been registered?

These are questions you should consider before committing to an LLC filing service. Check to see if they offer phone, email, or live online chat support. Then, get in touch to gauge their level of training and helpfulness.

WHAT DO THE ONLINE REVIEWS SAY?

Always read the reviews. Perhaps the best way to get a feel for the quality of a product or service is to read the reviews before making a purchase. This way you can gain an insight into how a company is performing.

There are a wealth of websites dedicated to reviewing companies nowadays. A quick google search will point you in the right direction. And, a little research now will pay dividends in ensuring you make an informed decision.

DO THEY PUSH UP-SELLING?

Beware of companies that try to up-sell you a service. This means they try to add on additional services that you don’t want or need. It is common practice for some companies to pressurize a customer into signing up for additional services they didn’t request.

Be clear with what you want and understand you are under no obligation to purchase products or services you do not need.

WHAT IS THEIR REFUND & CANCELLATION POLICY?

Does the company have a refund or cancellation policy? If things don’t work out and you want to cancel your application – can you get a refund?

Take a quick look at each company and check the small print for their cancellation and refund policy. Check to see if you can cancel your account at any time without incurring any fees or penalties.

WHY USE AN LLC FORMATION SERVICE?

What are the benefits of using an LLC registration company? Should you hire a professional LLC formation service or process the application yourself?

PEACE OF MIND

Engaging the services of an LLC formation company saves time and ensures the registration is completed correctly and all legal aspects are taken care of.

It gives you the peace of mind of knowing your registration will be completed professionally and quickly.

An LLC service will ensure all the legally required documents and forms are completed and submitted to the appropriate state authority.

ADDITIONAL SERVICES

They can also assist with creating your article of organization, accessing online documents, and determining company name availability, some thing we need to cover in our online LLC formation reviews.

LLC formation services offer legal and tax advice on how to run your newly founded company. This puts you on the best road from the very start and allows you to focus your efforts on running and growing your business.

ADVICE FOR USING AN LLC FORMATION SERVICE

SURVEY THE MARKET

There’s lots of competition out there. So, don’t jump at the first offer you find. Shop around and compare LLC formation companies and make sure you sign up for the service that works best for you.

KNOW YOUR ESSENTIAL SERVICES vs ADDITIONAL SERVICES

Be clear as to what is an essential service and what is an additional service. An essential service is something that must be done to get your LLC registered with the State. Everything else is an additional service.

Requirements vary from state to state but in general filing your Articles of Organization and appointing a registered agent are essential. Without completing these steps your LLC cannot be created.

LOOK FOR RECURRING FEES

When signing up for a service beware of recurring fees. Are recurring fees being factored into your bill? Failure to spot this could result in an unexpected bill. Clearly establish if the fee you are paying is a once-off or recurring annual fee.

DO YOU NEED A REGISTERED AGENT?

You must appoint a registered agent when setting up your LLC. However, you don’t have to use the registered agent service recommended by your LLC filing company. You can act as a registered agent yourself or appoint somebody else. For more see – What Is an LLC Registered Agent?

THERE ARE TWO TYPES OF EXPEDITED FILING

There are two types of expedited filing available for an additional fee. State expedited means your file will be processed more quickly at the state level. Internal expedited means your LLC filing company will prioritize your application in-house. It does not mean it will be processed more quickly at the state level.

EVALUATE POTENTIAL TAX BENEFITS OF S-CORPORATION

Some companies are eligible to register as an S-Corporation. This allows for a special type of tax status with the IRS and has some benefits, such as reduced payroll tax. Find out if you can register as an S-Corporation and if it is in your interests to do so. Most onbiased llc formation services can advise you on the formation of an S-Corp.

READ THE REVIEWS

Like buying any product or service – read the reviews. Find out what other people are saying about the company before you sign up for their services. Have previous customers had a positive or negative experience?

For more information see our – Tips For Using LLC Formation Services

HOW AN LLC FORMATION SERVICE WORKS

How does an LLC formation service work? Let’s take a look at how an LLC registration company processes your application – from the collection of your basic personal details through to the formation of your LLC company.

REGISTERS LLC WITH STATE AUTHORITY

The primary role of an LLC formation service is to process your application and register your LLC with State authorities. They offer the peace of mind that everything will be taken care of and your application will be processed quickly and correctly.

All you need to do to get the process started is provide some basic business and personal information and pay a fee. The fee you pay will cover the state registration fee and the fee charged by the service provider.

The registration company will then file your Article of Organization with the state authority. This is the document used to create an LLC. Once this is submitted, the creation of your LLC is in the hands of the State.

Another legal requirement is the appointment of a Registered Agent. You can choose a registered agent or ask the LLC formation company to act as one on your behalf – if this is a service they provide.

LEGAL COMPLIANCE

The best LLC service providers ensure your legal responsibilities and regulations are carefully seen to. This gives you peace of mind that all legalities are taken care of and you can get on with running your business.

The regulations for registering an LLC differ from state to state and it can be a time consuming process trying to figure out exactly what needs to be done. Hiring an LLC formation service frees means you can leave this in the hands of the professionals.

MAINTAINING YOUR LLC REGISTRATION

Maintaining your LLC requires yearly input and the completion of several tasks. The best LLC formation companies offer ongoing support in keeping your LLC filing accurate and up-to-date.

ACT AS MIDDLEMAN

An LLC formation service can act as a middle man between your company and the State authorities. Any requests for forms or annual reports can be fielded by your LLC formation company making it easier for you to focus on your company.

ADDITIONAL SERVICES

In addition, many LLC registration companies offer a range of additional services that may be appealing to you. They include registered agent services, tax advice, and business insurance advice.

RELATED

WHAT IS AN LLC?

An LLC is a type of business structure that protects its owners from personal liability for its debts. It stands for Limited Liability Company.

An LLC is a hybrid business structure that combines some of the characteristics of a corporation, partnership, and sole proprietorship. It benefits from both the limited liability of a corporation and pass-through taxation similar to a partnership.

While an LLC provides similar liability protection as a corporation, it is much easier to set up and run. It is a very popular company structure throughout the US.

An LLC can be used to own and run any type of business – from a small family business to some of the biggest companies in the world. Other types of business structure include corporation, sole proprietorship, and partnership.

• For more information see – What Is an LLC Company?

WHY FORM AN LLC?

There are several advantages to forming an LLC. An LLC combines the best features of a corporation business structure with those of a sole proprietorship or partnership. The key benefits of an LLC company are – see below.

PERSONAL ASSETS PROTECTION

One of the main advantages of an LLC is it offers protection for the personal assets of the owners. If the company falls into debt the assets of the owners will not be pursued to cover those debts.

The LLC is recognized as a separate legal entity. This means assets belonging to other people are not reachable by business creditors. In general, a member’s liability is limited to the amount of capital they have invested in the company.

This is comparable to the liability protection enjoyed by the shareholders of a corporation. They too are protected against the liabilities of the company they hold shares in.

TAX BENEFITS

Another great advantage of an LLC is the tax advantage it offers. LLC’s benefit from a form of taxation called pass-through taxation. This means the earnings on an LLC are taxed only once. This tax benefit is a very attractive feature of an LLC.

The earnings made by the company pass through to its members without being taxed. They pass through to the owners of the company in full. Tax is then applied at the individual level in the form of personal income tax.

An LLC effectively combines the liability protection of a corporation with the pass-through tax benefits of a partnership, a sole proprietorship, or an S-Corporation. For more see – How LLCs Are Taxed.

OWNERSHIP FLEXIBILITY

LLC companies offer great ownership flexibility. There is no restriction on the number or types of owners. It is not restricted in the same way as a corporation.

For example, an S-Corporation is limited to a maximum of 100 stockholders. And, each stockholder must be a citizen or resident of the United States. You have greater leeway with an LLC

SALE OF OWNERSHIP

The company structure makes it easy to process a sale of ownership. You can sell ownership interests in an LLC without disrupting the smooth operation of the business.

Processing a change in ownership is a complicated process when it comes to a sole proprietorship or partnership. For example, in these business models, you will need to individually transfer the ownership of assets such as bank accounts, legal documentation, business licenses, and working permits.

COMPANY LEGITIMACY

An LLC offers a business greater credibility compared to a sole proprietorship or general partnership. Those three letters at the end of your company name show that your operation is legitimate, recognized by the state, and is a stand-alone legal entity.

This can open doors and smoothen relationships with other companies, suppliers, financial institutions, and potential investors. An LLC is a real business and not an individual engaging in an enterprise.

SIMPLE MANAGEMENT STRUCTURE

An LLC has a simple management structure. An LLC can form any management structure as long as it is agreed upon by its members. And, profit interests can be separated from voting interests.

This allows people involved in the day-to-day running of the company can be given voting rights on how the business should be managed.

An LLC Operating Agreement is a legal document that can be written to formally define how the company will be managed. It outlines the ownership structure and member roles within the company.

Although it’s not a legally required document, they are recommended as they provide clarity and a written record of how the company is to be managed.

RAISING CAPITAL

LLC companies can raise capital by courting outside investors. In return, you can repay your investors in full plus interest, or you can offer them an ownership stake (equity) in the business.

When someone invests in an LLC they can become a ‘member’ of the company. When this happens, they receive an ownership stake in the company.

This is a great way to raise capital compared to a corporation as you can do so without the investors pressurizing the company for a quick return on investment and an exit strategy. For more see – Advantages and Disadvantages of LLCs.

HOW TO FORM AN LLC

How do you form an LLC? What are the steps involved? An LLC is a business structure that offers many benefits to its owners. While the procedure varies from state to state, here are the general steps you need to take to get one set up.

ARTICLES OF ORGANIZATION

The first step in setting up an LLC is completing a document called ‘Articles of Organization’ for your company. This document captures all the information required by the state to register your new company.

Once you have completed the document you must submit it to the appropriate state authority – usually the secretary of state. The creation of your LLC is now in the hands of the government. For more check out our full guide – LLC Articles of Organization.

REGISTERED AGENT

You must assign a registered agent for your company. This is a person that will receive legal correspondence on behalf of the company. They agree to receive important legal and tax documents on behalf of the LLC and pass them on to the company owners.

You can appoint yourself, a third-party, or an LLC formation service as your registered agent. For more information on the benefits of using a professional service see – Pros & Cons of a Registered Agent Service.

PAYMENT OF FEES

You will need to pay an LLC filing fee to establish your LLC. The fee will be paid to your state authority and the amount due varies from state to state. The figure ranges from $40 to $500, with $132 being the average.

Your LLC filing fee is a once-off registration fee paid to form your LLC. However, you will also have to pay an LLC annual or biennial fee to maintain your registration. Most states will deregister your LLC if you fail to pay this fee and your LLC will no longer exist.

OPERATING AGREEMENT

An operating agreement is a legal document that outlines how the company will be run and managed. Although it is not a legally required document it is highly recommended that the company owners create one.

An operating agreement provides clarity to all LLC members of ownership and voting rights. It should be agreed upon and signed by all members at the outset of forming the company. For more info see – What Is an LLC Operating Agreement?

NEWSPAPER PUBLICATION

Some states require a newspaper publication advertising that the LLC has been formed. This notice must be published in one or several local papers. The states of New York, Arizona, and Nebraska require a newspaper publication.

EIN FEDERAL TAX NUMBER

You’ll need to get an EIN to create a bank account for your LLC and to pay your employees. Your EIN is the tax number the IRS will use for all correspondence with the LLC. It will run for the lifetime of the company.

For more information on the steps needed to create your company, see – How to Start an LLC Business.

WHAT OTHER TYPES OF BUSINESS STRUCTURE EXIST?

There are nine types of business structures available to choose from. They are Limited Liability Company, Sole Proprietorship, Partnership, Corporation, S Corporation, B Corporation, Close Corporation, Non-Profit Corporation, and Co-Operative. Let’s take a look at how each works.

SOLE PROPRIETORSHIP

A sole proprietorship is the simplest business structure available. Anyone who creates a business and does not register for any of the other business models automatically becomes a sole proprietor.

A sole proprietor has complete control over their business. They must keep all their own company records and pay taxes as part of their self-employment taxes.

This business model offers no protection to the owner from company debts. They are legally personally responsible for any debts run up by the company. Despite this, it is the most common business structure in the US.

For more information check out our guide to – LLC vs Sole Proprietorship.

PARTNERSHIP

A partnership business structure involves two or more people coming together to run a business. Each partner has an equal share in the business. The profits or losses of the company are split evenly between the partners.

Partners pay tax on company earnings through their personal tax returns. They also have to pay self-employment taxes to the IRS.

In a partnership business structure, the individual partners are personally liable for any debt run up by the company. In most cases, they do not enjoy the same limited liability protection as an LLC. For more see – LLC vs Partnership.

C CORPORATION

A corporation business structure offers the greatest level of liability protection to its owners – even better than an LLC. However, the cost of creating a corporation is higher and they are more difficult to run and operate.

Corporations are sometimes called C corps and are recognized as separate legal entities. The profits made by a corporation are taxed and the company itself can be held legally liable.

Running a corporation is a complex affair and involves regular reporting and record keeping. Also, they can be subject to double taxation.

The profits made by a corporation are subject to tax. And, the dividends paid to the shareholders are subject to personal tax returns. For more information see – LLC vs C Corp.

S CORPORATION

An S corporation is a special type of company that’s designed to avoid the double taxation of a regular C corp corporation. S corporations allow company profits to pass through directly to the shareholders without being subjected to tax.

The IRS outlines the eligibility requirements a company must meet to be able to register as an S corp. This means these companies are not registered at the state level, but with the IRS instead.

They are a great choice for some companies that want to form as a C corp but meet the requirements of an S corp – and avail of the tax benefits.

However, some states place a cap on the S corps tax-free profits. They then tax earnings that exceed this specified limit. For more see – LLC vs S Corp.

BENEFIT CORPORATION

A benefit corporation structure can be used by a company that aims to provide some kind of public benefit and also generate profit for its owners. Also known as a B corp they are driven by both a public mission and profit.

They are often required to complete annual reports documenting the benefits they are providing to public life. These companies are taxed in the same way as a regular C corp corporation.

CLOSE CORPORATION

Close corporations are similar to B corporations but are generally smaller companies. They employ a less formal corporate structure that fits well for a smaller company.

These companies can be run by a group of shareholders without forming a board of directors. Most states do not allow the public trading of shares for a close corporation.

NON PROFIT CORPORATION

A non-profit corporation is a company that does charity, education, literary, scientific, or religious work. Non-profit companies benefit from a special tax exemption. This means they do not have to pay any state or federal tax on the profits they make.

Non-profit companies qualify for this tax exemption because the work they do is considered to benefit the public. These companies register directly with the IRS to receive their tax exemption.

They follow a different process compared to the other company structures that register with their state. And, the organizational rules that govern the operation of a non-profit are very similar to those for a C corporation.

However, the profits made by a non-profit company cannot be distributed to its members. There are strict rules that dictate how this money can be spent. Non-profit organizations are sometimes referred to as 501(c)(3) corporations.

CO-OPERATIVE

A co-operative is a company that is owned and operated for the benefit of the people that use its services. It is run by a board of elected directors and regular voters hold voting rights that control the direction of the company.

Profits made by a co-operative are distributed amongst its members. You become a member of a cooperative by purchasing shares within the company. However, the number of shares held does not affect the weight of a member’s vote.

Co-operatives work well for a group of people who have a shared specific need and are willing to work together. Members of a co-operative are known as user-owners.

LIMITED LIABILITY COMPANY

As discussed earlier, the LLC company structure is a hybrid model that combines some of the benefits of a corporation, sole proprietorship, and partnership. It combines the benefits of corporate limited liability with the pass-through taxation of a partnership or sole proprietorship.

The owners of an LLC are known as members and only pay tax on company profits as part of their personal tax returns. They are also afforded limited liability that protects them from being pursued for the debts incurred by the company.

BEST LLC FORMATION COMPANIES REVIEWS – FREQUENTLY ASKED QUESTIONS

WHAT ARE LLC FORMATION SERVICES?

LLC formation service companies specialize in officially registering LLC companies. They assist with the process of filing all the necessary paperwork with the appropriate state authority.

These companies provide a professional service that ensures the application will be processed correctly and all legal requirements are taken care of. They have expertise in liaising with state bureaucracies and will help get your LLC set up quickly and stress-free.

HOW MUCH DO LLC FORMATION COMPANIES COST?

The cost of an LLC formation service varies from one company to the next and the level of service being offered. Basic filing packages start out at between $40 to $80. You can expect to pay more as you add additional services.

Also, you need to factor in the state registration fee for the state you choose to register your LLC in. These fees vary greatly from state to state, ranging from $40 to $500.

WHAT DO LLC FORMATION COMPANIES DO?

LLC formation companies provide a professional service to help you set up your LLC business. They specialize in processing LLC filings and will ensure everything is completed correctly and promptly. This frees you up to focus on running and growing your business.

The exact process will vary from company to company. In general, an LLC formation service will take care of the entire business filing procedure.

They often offer additional services such as a registered agent, an LLC operating agreement, and an EIN federal tax number to allow you to open a business bank account and pay taxes.

WHERE IS THE BEST STATE TO REGISTER MY LLC?

The best state to register your LLC in is the state you plan on doing business in. Registering your LLC in a different state runs the risk of duplicating paperwork and costs.

If you form your LLC in a different state you may have to register as a foreign LLC in your home state. This will result in additional fees and taxes. We recommend you register your LLC in the state you plan to operate your business.

WHAT IS AN EIN NUMBER?

An EIN number is an Employer Identification Number. It is a number issued by the IRS to identify a business. EIN numbers are unique nine-digit numbers that allows the Internal Revenue Service to identify a business for tax reporting. They are also known as Federal Tax Identification Numbers. You can get an EIN for free by applying to the IRS.

CAN I REGISTER MY LLC FOR FREE?

No, you cannot register your LLC for free. Every state requires the payment of some kind of fee or filing charge. The cost of forming an LLC varies from state to state. Basic filing fees range from $40-$500. Check out our state-by-state guide for the formation and maintenance costs on How Much Does an LLC Cost?

WHAT’S THE DIFFERENCE BETWEEN AN LLC AND A SOLE PROPRIETORSHIP?

A sole proprietorship is a business owned and run by one person. It is the simplest form of business structure that exists. It is an unincorporated business structure and all the profits go through to the business owner.

An LLC is a legal entity that exists separate from its owners. It is formed at the state level and can have multiple owners called members. The members of an LLC are not personally responsible for the company’s debts.

DO I NEED A REGISTERED AGENT FOR MY LLC?

Yes, every LLC is required by law to have a registered agent. A registered agent is the point of contact for your company for any official or legal correspondence. You can assign yourself, a friend, or a family member as your registered agent. Or, you can hire the services of a registered agent service if you prefer.

DO I NEED AN OPERATING AGREEMENT?

Although an operating agreement is not a requirement for LLCs in all states it is still a good idea to create one. An operating agreement formally defines how the company is operated and describes the agreements between the various members of the company.

WHAT’S THE FASTEST WAY TO GET AN LLC REGISTERED?

The fastest way to get an LLC registered is to use an online LLC formation service. All the best LLC formation companies covered in this review have an expedited option that allows you to have your LLC formation pushed through as fast as possible. If you need your company formed ASAP, check out the reviews above.

DO I NEED AN ATTORNEY TO FORM AN LLC?

No, you don’t need an attorney to form an LLC. You can form an LLC yourself, or you can use a professional LLC formation service. If you need legal advice on the running of your business you should consult an attorney.

CAN I HIRE AN ATTORNEY TO REGISTER MY LLC?

You can hire an attorney to assist you through the process of forming an LLC. However, hiring an attorney is not a requirement and many people choose to form an LLC themselves or hire a formation company for assistance. In general, hiring an LLC formation company will be much cheaper than hiring an attorney.

WHAT ARE THE BENEFITS OF FORMING AN LLC FOR PROPERTY RENTAL?

There are a number of benefits for forming an LLC for a property rental business. However, the main advantage is liability protection for the owner. By forming an LLC the owner cannot be sued personally if a tenant suffers an injury on the property. For more information see – LLC For Property Rentals.

HOW MUCH IS THE STATE FEE FOR SETTING UP AN LLC?

The state fee for setting up an LLC varies from state to state. Forming an LLC in the state of Kentucky comes with a state filing fee of just $40. In Massachusetts, it will cost you $500. So, depending on the state you choose to form your LLC you can expect to pay somewhere between $40-$500.

WHAT ARE THE TOP LLC FORMATION FORMATION COMPANIES?

The Top 5 LLC Formation Services are Northwest, Zen Business, Rocket Lawyer, Inc File, and Legal Zoom. This is our selection for top LLC formation companies for 2026.

WHAT’S THE BEST LLC SERVICE IN IDAHO?

The best LLC service in Idaho is the online service provided by Northwest.

About the Author

Jason Roth: Editor in Chief

Jason is editor in chief at My LLC Guide. He holds a wealth of business management experience and has been advising companies on business formation issues for many years. Jason specializes in resource planning management, staff utilization, and productivity consulting.

He has worked predominantly in the west coast area where he graduated from the Marshall Business School at the University of South California. When he’s not working in his business advisory role, Jason likes to climb on his Indian Scout motorbike and enjoy the open road.