LLC California Costs vary depending on the nature of your company and how you choose to run it. The fee for filing an LLC in California has been waived until June 30, 2023. This is the main fee associated with forming an LLC in California. However, there are several additional LLC California costs that apply to forming and operating an LLC in the state, see below.

LLC CALIFORNIA COSTS

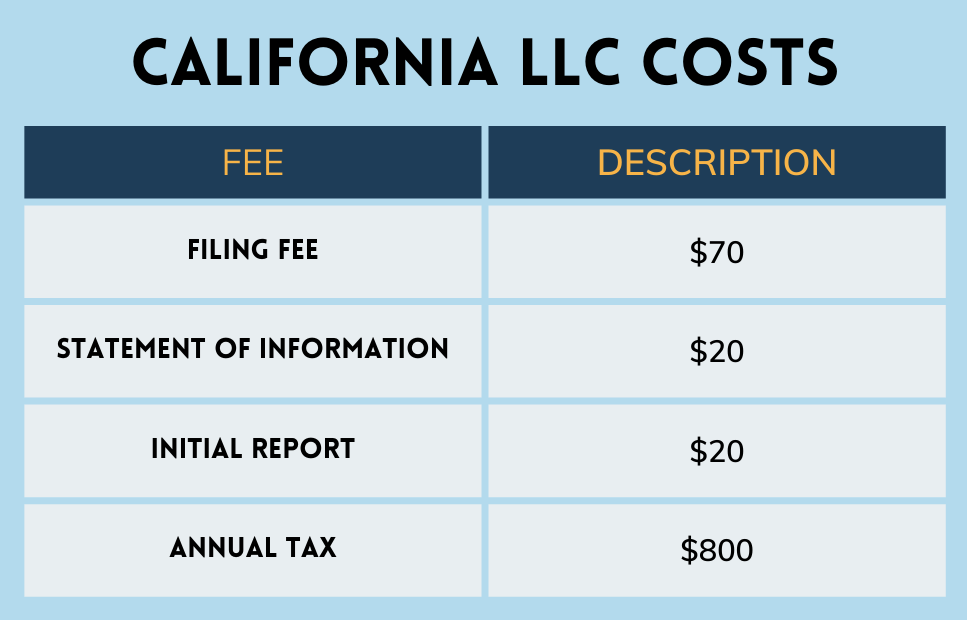

The costs of forming and running an LLC in California can be broken down into three categories – Standard Costs, Additional Costs, and an LLC Fee for companies with annual revenue above $250,000. The standard costs are costs all California LLCs can expect to pay. Additional costs cover once-off fees for optional services and specific business needs. And, an LLC Fee that applies only if your company is generating more than $250,000 in revenue.

STANDARD COSTS FOR A CALIFORNIA LLC

Forming an LLC in California comes with standard costs that every company must pay. These include initial formation fees and recurring taxes that are paid to the California Secretary of State. An understanding of these fees allows business owners to avoid surprises and plan for the financial year ahead.

Note: the Filing Fee for submitting your Articles of Organization with the California Secretary of State has been waived until June 30, 2023.

FILING FEE

The main fee for forming an LLC in the state of California is the filing fee. This is the fee you pay when submitting your California Articles of Organization to the Secretary of State. The easiest way to do this is online via the Secretary of State’s website. The California filing fee is $70.

STATEMENT OF INFORMATION

Statement of Information is a biennial report you must file with the California Secretary of State. You must pay a fee of $20 when submitting the statement.

INITIAL REPORT

An Initial Report must be filed by all newly formed California LLCs within 90 days of registration. You must complete Form LLC-12 and submit it to the Secretary of State along with a fee of $20.

ANNUAL TAX

All California LLCs must pay an Annual tax. This is often referred to as a Franchise Tax. The tax is applied to all LLCs regardless of whether they have been active in the financial year. It is charged at a fixed rate of $800.

READ NEXT

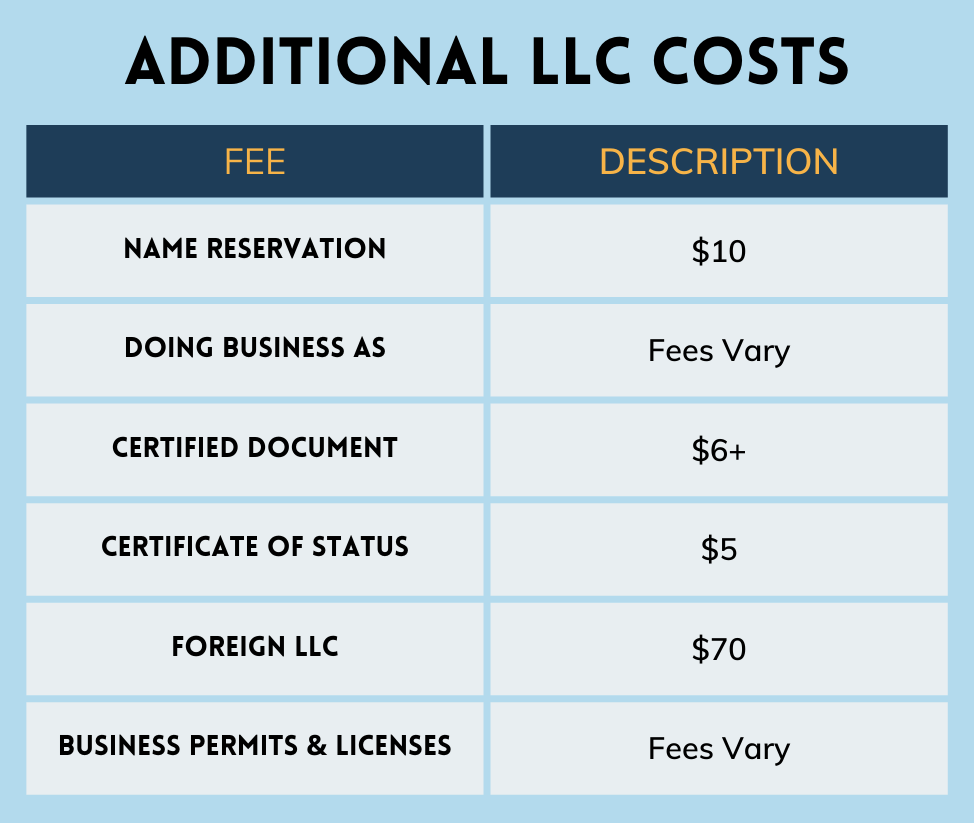

ADDITIONAL LLC CALIFORNIA COSTS

In addition to the standard LLC California costs, several additional charges may apply to an LLC. These charges are associated with optional services and specific business needs that may or may not apply to your business.

NAME RESERVATION FEE

The name reservation fee applies if you want to reserve a company name for up to 60 days before you form an LLC. If you find that your preferred company name is available you can lock it down by completing a Name Reservation Request Form and paying a $10 fee.

DOING BUSINESS AS (DBA)

A Doing Business As name allows you to operate a company using a trading name different from the name you officially register on the company’s Articles of Organization. It is also commonly referred to as a “DBA”. The fee for registering a DBA varies by county and city. Contact your local authority for further details.

CERTIFIED DOCUMENTS

If you need to get hold of a copy of your official documents from the California Secretary of State you will have to pay a certified documents fee. The fee is charged at $6 for the first page, plus 50 cents for each additional page.

CERTIFICATE OF STATUS

A certificate of status is an official document issued by the secretary of state that proves your company officially exists and is in compliance with all state requirements. It is also known as a Certificate of Good Standing. A fee of $5 must be paid to receive the certificate.

FOREIGN LLC

A foreign LLC is an LLC that is already registered in another state but needs to register in California also, to do business in the state. The fee for registering a foreign LLC in California is $70. It is a one-off fee and should be paid on submission of Form LLC-5 Application to Register a Foreign Limited Liability Company.

BUSINESS LICENSES & PERMITS

Depending on the nature and location of your company you may need to apply for federal, state, and local business licenses and permits. For example, if you operate in a federally regulated industry such as Agriculture, Fishing, or broadcasting you’ll need to apply for a federal license. For more information see Business Licenses for LLCs.

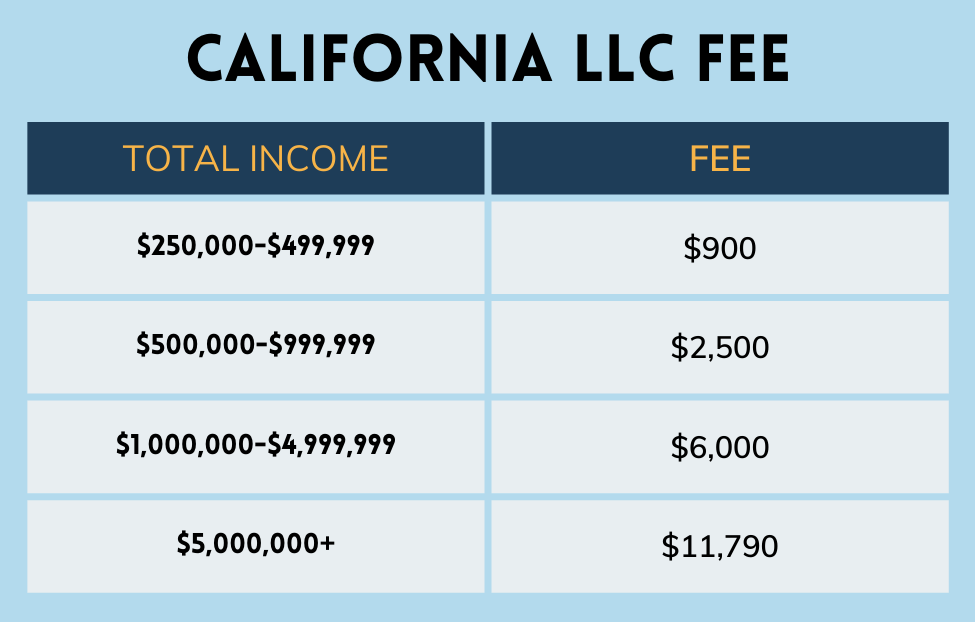

LLC FEE – FOR LARGER COMPANIES

If your LLC generates more than $250,000 in revenue you will have to pay an LLC fee. The fee varies from $900-$11,790 depending on the volume of income generated. This fee must be paid by the 15th day of the sixth month of the tax year. See below for a breakdown of fees per company earnings.

RELATED

RESOURCES

CALIFORNIA SECRETARY OF STATE

Address:

California Secretary of State

1500 11th Street

Sacramento, CA 95814

Public Contact Information

Phone:

(916) 653-6814

Office hours are Monday through Friday – 8:00 a.m. to 5:00 p.m – excluding state holidays.

Website:

BizFile Online – click here

About the Author

Erik Chambers: Senior Editor

Erik is a 30-year industry veteran with a wealth of experience in cross-functional areas ranging from business consulting to business education. He has worked in the private sector where he has advised start-up enterprises on early formation, capital acquisition, and tax issues.

While he specializes in business formation he has also held roles in several academic institutions where he teaches organizational decision-making, business strategy, and operations management. Erik is a graduate of the McCombs School of Business at the University of Texas at Austin.