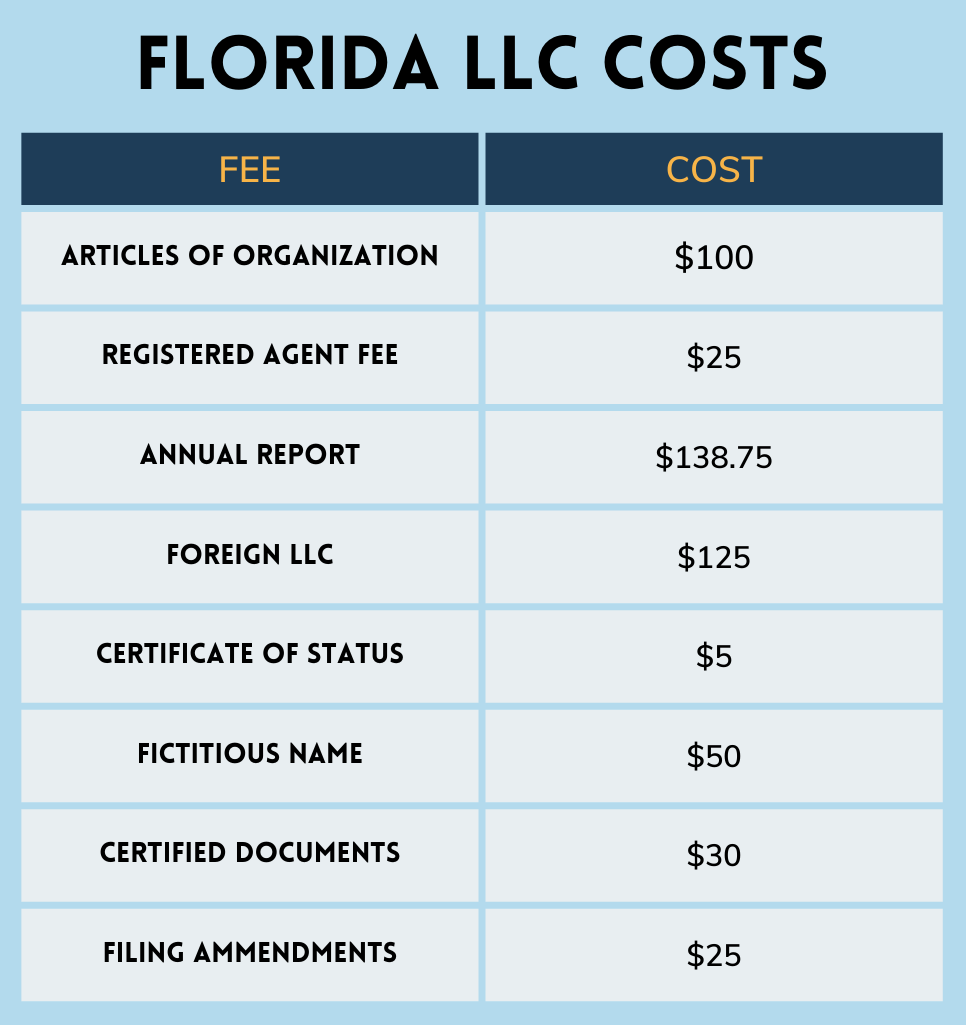

It costs $125 to form an LLC in Florida. This includes a $100 fee to file your Articles of Organization and $25 for a Statement of Registered Agent. These two forms must be completed and filed with the Florida Department of State. Additional Florida LLC costs include Annual Report, Certificate of Status, Fictitious Name, and Certified Document Copy fees. See below for an overview of LLC costs in Florida.

Florida LLC Costs

The main costs involved in forming and running an LLC in Florida are the fees associated with filing the company’s Articles of Organization and Statement of Registered Agent forms. These fees amount to a total of $125. You must also submit an Annual Report and pay a fee of $138.75 every 12 months. Other costs may apply relating to the processing of additional forms and requests for copies of official documents.

In this Article

- Articles of Organization

- Registered Agent Fee

- Annual Report

- Foreign LLC

- Certificate of Status

- Fictitious Name

- Certified Document Copies

- Filing Amendments

- Business Licenses & Permits

- Change of Registered Agent

- Certificate of Conversion

Articles of Organization

To form an LLC in Florida you must complete a document called Articles of Organization and submit it to the Florida Department of State. This document captures all the information the state authority needs to approve and officially establish your LLC. You must pay a fee of $100 when filing your company Articles of Organization.

Registered Agent Fee

A registered agent is a business or individual that agrees to receive official and legal paperwork on behalf of the company. All Florida LLCs must appoint a registered agent. When you form an LLC you must complete a Statement of Registered Agent form and submit it along with a fee of $25.

Annual Report

All Florida LLCs must submit an Annual Report to the Florida Department of State. This document captures an up-to-date snapshot of all important company details and provides an overview of its financial performance over the last 12 months. The report must be completed and filed online between January 1st and May 1st and comes with a $138.75. If the report is not filed on time, a $400 late fee will be charged.

READ NEXT

Foreign LLC

A Foreign LLC is an LLC that is already registered in another state but needs to register in Florida to conduct business in the state. If you need to form a foreign LLC in Florida you must complete an Application by Foreign LLC for Authorization to Transact Business in Florida form and pay a fee of $125.

Certificate of Status

A Certificate of Status is an official document issued by the Florida Department of State that shows your LLC is in good standing and is currently in compliance with state requirements. It is often referred to as a Florida certificate of good standing. You may need this document to open a Business Bank Account for your LLC or to apply for a loan. A fee of $5 applies to the issuance of the certificate.

Fictitious Name

A Fictitious Name allows a company to operate under a name different from the name registered in its Articles of Organization document. It is also known as a Doing Business As or DBA name. Fictitious names are often adopted for branding purposes or when a company expands into a new market. To register a DBA you must complete a Fictitious Name Registration form and pay a fee of $50.

Certified Document Copies

Occasionally companies need to produce official copies of documents to facilitate transactions – such as opening a business bank account. If you need to obtain a copy of an official company document such as your Articles of Organization you must pay a fee of $30.

Filing Amendments

If you need to make an amendment to a document held on file by the Florida Department of State you must pay a Filing Amendment fee of $25. The document most commonly amended by a Florida LLC is its Articles of Organization.

Change of Registered Agent

If for whatever reason, the company needs to appoint a new registered agent you must file a new Statement of Registered Agent and pay an additional fee of $25. Florida LLCs must maintain a registered agent at all times to receive official and legal correspondence.

Business Licenses & Permits

Business licenses and permits are additional Florida LLC costs. And, they are often overlooked. Depending on the nature and location of your company you may need to apply for local, state, and federal licenses and permits.

The fees associated with these vary. The best course of action is to reach out to local and federal authorities to determine the precise requirements for your company. For more information check out LLC Business License & Permits.

Certificate of Conversion

If you decide to convert your LLC to a corporation you must complete and submit a Certificate of Conversion. Some LLCs choose to convert to corporations if they deem it is in their financial interests. You must pay a fee of $25 when submitting a Certificate of Conversion.

For more information, check out:

Expedited Filing

The Florida Department of State does not offer expedited filing for LLC business documents. They do facilitate online submissions and walk-in filing requests. Online requests are processed in the order they are received. And, walk-in requests are handled as requested and can be processed while you wait. You can visit the Florida Department of State at 2415 N, Monroe Street, Suite 810 Tallahassee, FL 32303. Their office hours are Monday to Friday, 8am to 5pm.

10 Steps to Forming an LLC in Florida

Below is an overview of the 10 steps involved in forming an LLC in Florida. For more information check out How to Form an LLC in Florida.

- Choose a Name

- Appoint a Registered Agent

- Submit Articles of Organization

- Create an Operating Agreement

- Choose a Tax Code

- Get a Company EIN

- Obtain Business Licenses/Permits

- Open a Business Bank Account

- Assess Florida Employer Regulations

- File Annual Reports

Resources

Below is a list of resources and contact details for the Florida Department of State required for forming and operating LLCs in Florida.

• Florida Department of State

The Centre of Tallahassee

2415 N. Monroe Street, Suite 810

Tallahassee, FL 32303

• Office Hours

Monday to Friday

8am–5pm

• Mail Address

P. O. Box 6327

Tallahassee, FL 32314

850.245.6000

850.245.6014 (fax)

• Website

Florida Department of State

• Florida LLC – Articles of Organization

Phone: 850.245.6052

Email: NewFilingsCorpHelp@DOS.MyFlorida.com

• LLC Amendments & Registered Agent Changes

Phone: 850.245.6050

Email: AmendmentsCorpHelp@DOS.MyFlorida.com

• LLC Annual Reports & Reinstatements

Phone: 850.245.6059

Email: FICARReinstCorpHelp@DOS.MyFlorida.com

• LLC Mergers

Phone: 850.245.6050

Email: AmendmentsCorpHelp@DOS.MyFlorida.com

• Foreign LLC Qualification

Phone: 850.245.6051

Email: RegistrationsCorpHelp@DOS.MyFlorida.com

RELATED

About the Author

Erik Chambers: Senior Editor

Erik is a 30-year industry veteran with a wealth of experience in cross-functional areas ranging from business consulting to business education. He has worked in the private sector where he has advised start-up enterprises on early formation, capital acquisition, and tax issues.

While he specializes in business formation he has also held roles in several academic institutions where he teaches organizational decision-making, business strategy, and operations management. Erik is a graduate of the McCombs School of Business at the University of Texas at Austin.